|

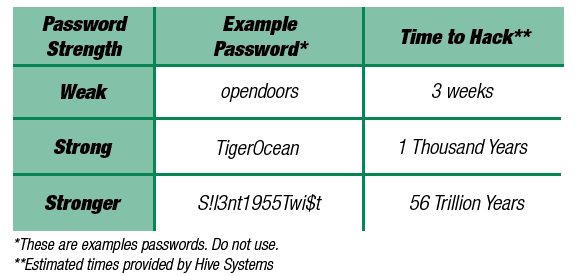

Is Your Password Strong Enough?A strong and complex password makes it significantly harder for cybercriminals to access your accounts, protecting personal and sensitive information. Cyber attacks often involve automated tools that can quickly identify weak passwords.

Once any password is found in a breach, your sensitive information is in jeopardy and is susceptible to instant access by cybercriminals. It is extremely important that you do not reuse the same password for multiple logins. Reusing passwords anywhere online is unsafe. While convenient, storing passwords in your browser poses significant security risks, as anyone with access to your device or a compromised browser can easily access your stored credentials. In addition to having a strong password, it is always best practice to check your accounts regularly and enable any alert services that are provided. For more information about password safety, please visit the Hive Systems. |

|

Fraud Prevention: What Can You Do?Scammers are always looking for new victims, and seniors are on their list. These crooks use many ways to target your money or personal information. Here are some things to look for and some suggestions about what to do if you think you might be a victim. Don’t rush into financial decisions. If you’re unsure about anything, ask for an explanation or say you need more time to think about it. Don’t feel pressured to make snap decisions. Don’t give out personal information such as account numbers, your Social Security number, or your debit or credit card numbers unless you’re sure it’s necessary.

|

Beware of Fictitious Wire InstructionsBeware of Sneaky Wire Transfer Email Fraud Ever sent a wire transfer for a business deal, only to realize later it was a hoax? Scammers are always looking for new methods, and wire transfer fraud, a specific type of Business Email Compromise (BEC), is a growing threat for both businesses and individuals. Let’s look at what wire transfer email fraud is, how it works, its impact on small businesses, and how to protect yourself from falling victim to such scams. This guide is especially relevant for small business owners, IT professionals, finance managers, and freelancers who are looking to safeguard their operations. Understanding Wire Transfer Email Fraud Wire transfer email fraud is a sophisticated scam that targets businesses and individuals by tricking them into wiring money to fraudulent accounts. Fraudsters typically gain access to email systems through phishing or malware and then use compromised accounts to send fake wire transfer instructions. One common tactic is the "updated instructions" scam, where scammers send revised wire transfer details to redirect funds to their accounts. How the Scam Works Imagine you're finalizing a legitimate transaction via email and receive wire transfer instructions. Later, you get another email, seemingly from the same person, with "updated" or "corrected" instructions. This new email might have a slightly different sender address or contain a sense of urgency, but it contains a different receiving account for the wire and sometimes new contact information for the sender. Here's the catch: it's a fake email! Scammers often compromise legitimate email accounts or create look-alike addresses to trick you into sending money to their accounts. Wire transfer email fraud usually begins with a phishing attack or malware infection that grants scammers access to an email account. Once inside, they monitor communications to identify ongoing transactions and then send fake wire transfer instructions. They often impersonate a trusted vendor or colleague to make the request appear legitimate.

|

|

|

|

|

|

Account Alerts

The best defense against account fraud is knowing when fraudulent activity takes place. Our Account Alerts system provides stronger security by delivering real-time account alerts. Receive alerts via online banking, text, email and push notifications. Alerts help you manage your account by monitoring your account balances and activity, getting deposit and withdraw notifications, controlling security alerts and more. For detailed instructions on how to set-up Account Alerts for your accounts, please view the video below. If you have any questions, please contact one of our experienced Bankers at (847) 432-7800. |

Identity Theft Protection | Personal & Business |

|

If you are a victim of identity theft, please use the following resources:Credit Reporting Companies

Federal Trade Commission

Social Security Administration SOCIALSECURITY.GOV type “Fraud” in the search box 1(800) 269-0271 Opt Out Opt out of pre-screened offers of credit or insurance: OPTOUTPRESCREEN.COM or 1(888) 567-8688 US Postal Service Mail theft or identity theft issues – 1(800) 275-8777 or 1(877) 876-2455 |